nj bait tax instructions

New Jersey Pass-Through Business Alternative Income Tax PTE Election. Good News in New Jersey.

Martin S Cyper Wsp Insect Killer Powder 4 X 9 5 Gm Ace Hardware

The New Jersey Division of Taxation and the Internal Revenue Service participate in a federalState program for the mutual ex-.

. NJ Income Tax Nonresidents. How to Pay Pass-through entities must. Pass-Through Business Alternative Income Tax PTEBAIT For New Jersey tax purposes income and losses of a pass-through entity are passed through to its members.

To access the NJ. This is an entity-level tax to work. Pass-Through Business Alternative Income Tax Act.

Corporation Business Tax Form. BAIT is calculated for partnerships so that all income not just New Jersey-sourced income is subject to the tax if the owner is a New Jersey resident individual estate or trust. Fourth sixth and ninth months of the current tax year and on or before the 15th day of the first month of the year following the close of the tax year.

The BAIT is imposed at the following rates based on the collective sum of all the PTEs members shares of distributive proceeds for the tax year. Bracket Changes As a result of the amendments the BAIT increases to the. General Instructions for New Jersey S Corporation.

CBT-100 Separate Filer. If the sum of each members. September 3 2021.

Official Site of The State of New Jersey. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local tax. Pass-Through Business Alternative Income Tax Act.

If you are a nonresident and your income for the entire year was more than the filing threshold amount for your filing status you must file a New. PL2019 c320 enacted the Pass-Through Business. Instructions for Completing the.

The concerns of passthrough. Business Alternative Income Tax BAIT Now ImprovedTaxpayer concerns result in modification of prior law. The New Jersey Division of Taxation has provided answers to several recent questions about the New Jersey Business Alternative Income Tax BAIT.

The New Jersey Business Alternative Income Tax or NJ BAIT allows pass-through businesses to pay income taxes at the entity level instead of the personal. Et al as may be applicable to the collection administration and enforcement of the New Jersey gross income tax provided in the New Jersey Gross Income Tax Act NJS54A1-1 et seq. Governor Phil Murphy Lt.

On January 13 2020 New Jersey Governor Phil Murphy signed the NJ SB3246 Pass-Through Business Alternative Income Tax Act into law. Pass-Through Business Alternative Income Tax PTEBAIT For New Jersey tax purposes income and losses of a pass-through entity are passed through to its members. Pass-Through Business Alternative Income Tax PTEBAIT Pass.

Form CBT-100 is online for reference purposes only. Returns must be filed electronically. The BAIT for New Jersey S Corporations continues to be limited to New Jersey-sourced income.

Number 12 Pages 1007 1120 Law Library The New Jersey State

Direct Deposit Of Your Income Tax Refund

When Down The Hall Becomes Across State Lines Part 1 1

Bamboozled Turbotax Error May Be A Problem If You Filed This Type Of Return Nj Com

Weekend Getaways To Ocnj Ocean City New Jersey Ocean City New Jersey

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

New Jersey Business Alternative Income Tax Nj Bait Tax Knowledge Hub

New Jersey Pass Through Business Alternative Income Tax Bait Updates Marcum Llp Accountants And Advisors

New Jersey Clarifies New Net Operating Loss Rules Grant Thornton

New Jersey Partnership Tax Login

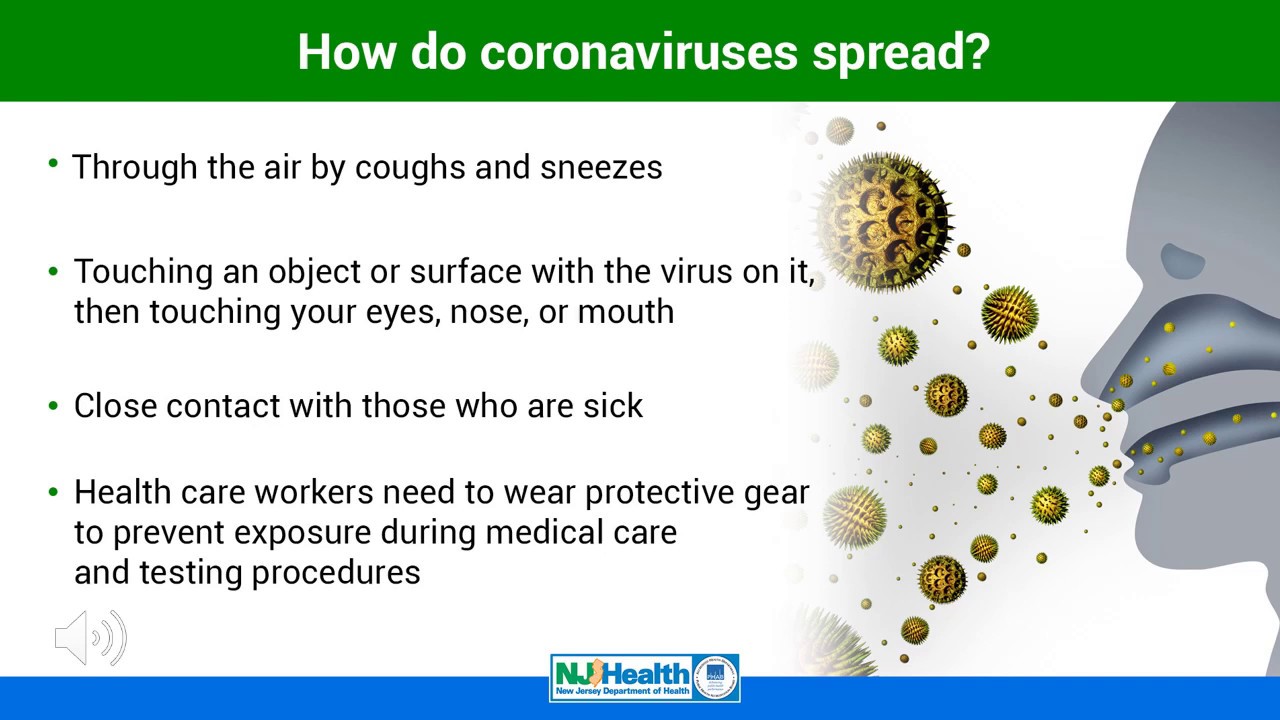

Covid 19 Montville Township Nj

New Jersey Pass Through Business Alternative Income Tax Act Curchin Nj Cpa

New Jersey State Tax Updates Withum

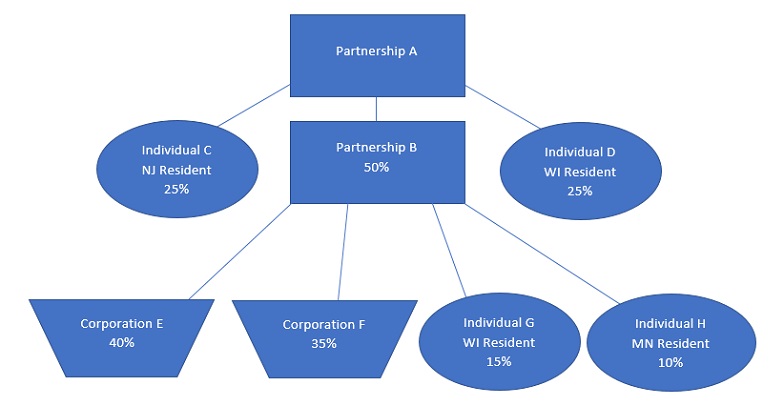

Dor Pass Through Entity Level Tax Partnership Determining Income And Computing Tax

Nj Bait Year End Tax Planning Considerations For Pass Through Entities Wilkinguttenplan

New Jersey State Tax Updates Withum

New Jersey Cpa January February 2021 By New Jersey Society Of Cpas Issuu